Blind trading, real results: Our algorithm delivered % swing trading gains across the S&P 500 (YTD 2025) and % gains (YTD 2025) across 50 monitored stocks—without anyone lifting a finger. From volatile stocks to market giants, we’ve put our tech to the test. See how we prove it works—and why it’s your edge.

How We Test: The Ultimate Challenge

We didn’t mess around. To build our algorithm, we picked 50 wild stocks*—think TSLA, PLTR, ATOS—packed with volatility to churn out WM patterns daily. Once it was live, we kept the heat on, tracking every alert with a brutal test: blind trading. No peeking at charts, no second-guessing—just raw, unfiltered trades based on what our algorithm says.

The rules? Buy at the first hit of the target (or higher), sell with a 0.25% trailing stop or at the stop-loss—day trades close at market end. For swing trading, we went bigger: the entire S&P 500, holding days to weeks. It’s the toughest proving ground—pure automation, real profits.

Real Results: Gains That Speak

Here’s what blind trading delivered in 2025 (YTD):

- Day Trading: % daily gains—% total—across 50 volatile stocks*. Steady wins, no sweat.

- Swing Trading: % daily gains—% total—across the S&P 500. Big growth, beginner-friendly.

Real trades, real proof:

- APPS, 2/10/25: Day trade alerted at $4.68, hit $5.14—+7.1% in ~90 minutes.

- S&P 500 Swing: TSLA, June 17 2024—+34.5% in 24 days, blindly traded.

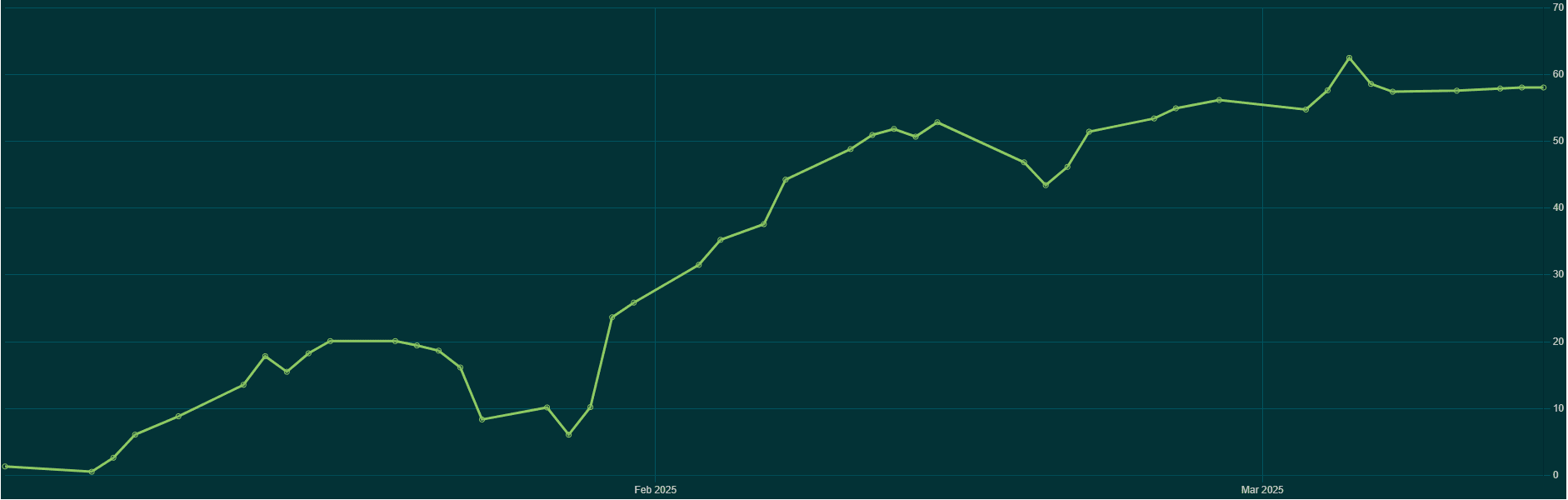

Our algorithm doesn’t just spot patterns—it stacks gains. See the swing trading curve below—% daily growth, no manual fuss.

Why It Works: Your Edge, Refined

vivimetrix isn’t guessing—it’s winning. Here’s how:

- Pattern Precision: Scans up to 10,000 stocks daily, nailing harmonic WM patterns in 5ms—direction, duration, done.

- Daily Learning: Analyzes every trade—wins, losses, skips—to cut noise and boost accuracy.

- Profit Focus: Fewer, smarter alerts—ignores shaky patterns, targets big payouts.

Day trading’s % daily adds up fast—% YTD on 50 stocks. Swing trading’s % daily explodes to % across the S&P 500. Pick your trades or ride them all—either way, you’re ahead. Soon, our confidence rating system will flag each alert’s odds, from “solid” to “slam dunk.”

*The Test Bed: 50 Volatile Stocks

We hand-picked these 50 for day trading—high flyers with pattern potential**:

| ABNB | APA | APPS | ASAN | ATOS |

| BIGC | BMBL | C | CAT | CHWY |

| CLF | CLOV | COTY | CPE | CWH |

| DASH | DIDI | DKNG | DQ | FB |

| FDX | FSLR | FUTU | GNRC | GS |

| IWM | KSS | LLY | LSCC | MPLN |

| NUGT | NVAX | OXY | PLTR | PTON |

| PYPL | QS | RIG | ROKU | RUN |

| SAVA | SCCO | SE | SKLZ | SNAP |

| SPCE | TDOC | TSLA | UPS | WISH |

**We are not recommending these stocks in any way. These are simply the 50 stocks we started using for testing our algorithm in August 2021 and we decided to stick with them for testing consistency.

Swing trading? We scaled it to the S&P 500—500 stocks, one unbeatable system.

Ready to Win?

From $1,000 accounts to pro portfolios, our algorithm proves it—gains without the grind. Start trading smarter today!